The purpose of the following brief case study is to make the reader aware that there may be distinct differences, particularly with smaller link profiles. This case focuses deliberately on smaller link profiles. The domains sought for this case are entirely SME pages from Berlin and respectively have a domain popularity of less than 60. In other words, fewer than 60 unique domains link to these domains. The intention has been to select domains from different industries. For example, a tradesman’s page, a tax office, building administration, a cosmetic studio etc. are represented. The analysed domains were purposefully kept anonymous; nevertheless, there is no business relationship between the author and the domains. The author is Majestic Ambassador for Germany.

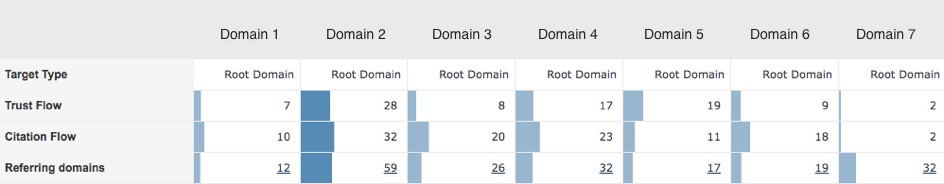

If you consider the flow values and the number of referring domains – as already mentioned in the introduction – none of the domains in the “Fresh Index” have more than 60 Referring Domains; the average is 28. It is interesting that, for almost all the domains, the citation flow is greater than the trust flow. Therefore, the link profiles of the domains are mostly more than trustworthy. As almost all the analysed domains have a naturally grown link profile, this is the result of natural linking. When the profile is actively optimised, however, it is noted that the distance is not too far, as this approaches deliberate optimisation with strong links.

It is worth mentioning that the domain with the second fewest referring domains has the second highest trust value. So it quickly became apparent, that it was as if, in the few existing domains, there were one or two that were accordingly expressed as trustworthy. That will be dealt with further below.

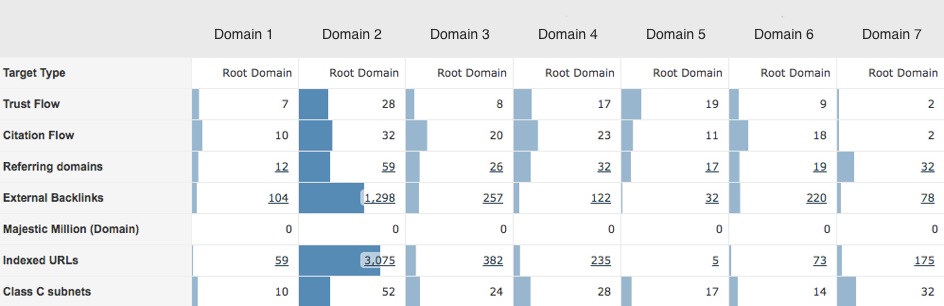

If the view above is extended by the total number of links referring to the domain, clear differences can be recognised. The following illustration shows that Domain 2, with the highest flow metrics and the most referring domains also has the highest total number of backlinks.

Of course, it then follows that Domain 2 has far and away the worst ratio (4.55%) of referring domains to the number of backlinks, compared with Domain 5, therefore, the only domain that had a higher Trust Flow than Citation Flow, which has the best ratio of 53.13 %. The latter even has the lowest number of backlinks and the second highest overall Trust Flow. For Domain 2, this may mean that there are many page-wide links (sidebar, footer) that push up the number of backlinks. A link risk analysis of the backlink profile would certainly make sense here.

As these domains are not from the same industries, no evaluation can be made conclusively, on the basis of typical industry values, as to whether the ratio of 4.55 % is bad. Note, however, that it should be examined how ratios from link analyses of competitors interrelate.

The figure will now be extended by the number of indexed pages and the Class C subnets. There are interesting data on the number of indexed pages, as marked discrepancies occur here. Domain 2 is the outlier again in this case, and has by far and away the highest value with more than 3 000 indexed pages. Whereas three domains are between approximately 175 and just below 400 indexed pages, it is noticeable that, surprisingly, Domain 5 has the fewest number of indexed pages. This is again the domain that is the only one with a higher Trust Flow than Citation Flow, and which has the best ratio of referring domains to the number of backlinks.

Of course, it then follows that the incoming links must be distributed over much fewer pages (note from author: in this context, a possible dark number of unindexable pages may conceivably be excluded) and therefore the link force distribution is particularly concentrated on that page.

For comparison, we utilise yet another metric: the Page Efficiency Index (PEI). The Page Efficiency Index is calculated from the value of the visibility index from Sistrix, divided by the number of indexed pages, multiplied by a factor of 100 000, to obtain readable values. For both domains, you get the following values: (status of visibility index: 4/9/2017)

Domain 2: 0.0477 / 3 075 * 100 000 = 1.55

Domain 5: 0.0127 / 5 * 100 000 = 254

As can be recognised, the visibility of Domain 2 is approximately four times the size of Domain 5, but Domain 2 has a distinctly worse PEI value.

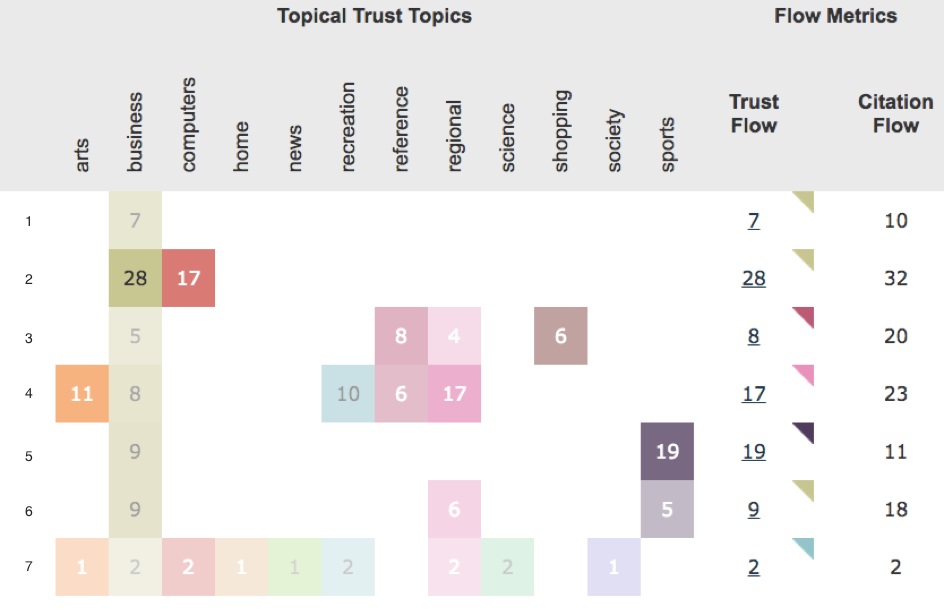

In this case study, the composition of the most important Topical Trust Topics of the domains are to be considered (for more background information on TTT see – https://blog.majestic.com/development/topicaltrustflow/ & https://blog.majestic.com/commentary/5-ways-successful-seos-topical-trust-flow/)

Therefore, this overview is fascinating, as it shows from which topical areas the links to the web pages come and thus makes it comparable and reviewable, whether the content of the links fit the domain or not. Majestic Marketing Director Dixon Jones once commented on TTT:

“For the first time, it becomes blatantly obvious why a link “anywhere” on a site isn’t enough… unless that site is very focused.”

The idea is that a domain that relates to a given topic also has a corresponding link profile – at least we can anticipate this. However, if the domain now points to many links from very different topical areas, on the one hand, this could mean a lower topical reference of the domain than anticipated, or even expose – with regard to the link – the deliberate (but topically misdirected) optimisation of the profile. This then must lead to the question as to whether off-topic links are equivalent to topical links.

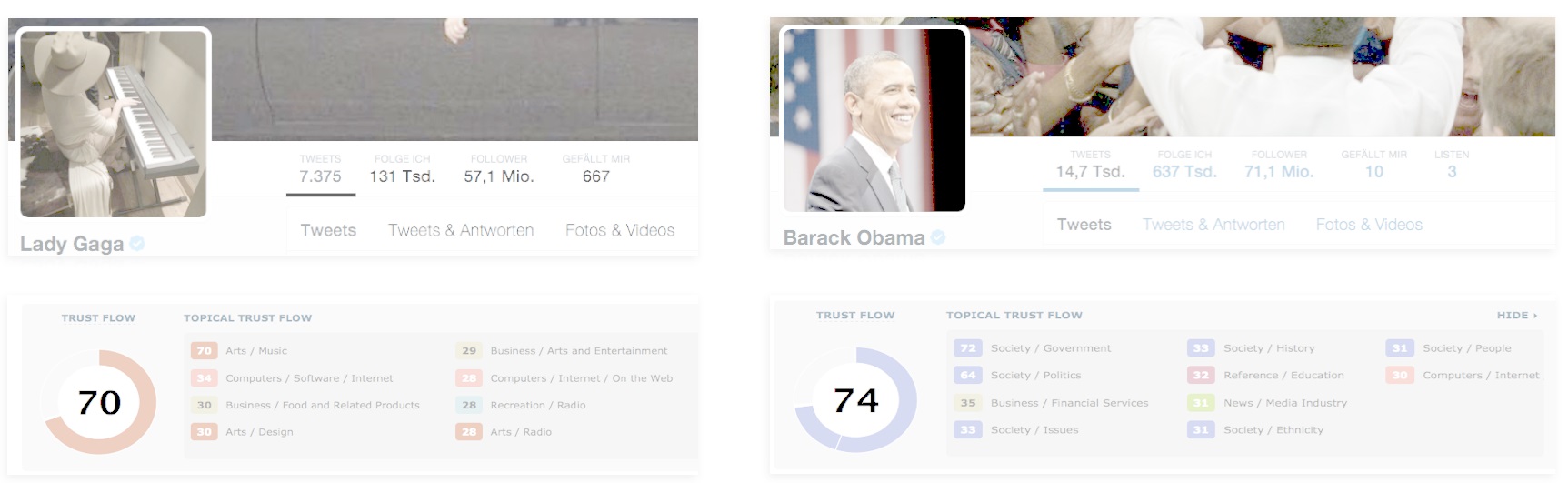

Here is an example of the Twitter profiles of Lady Gaga and Obama. If you look at the topical composition of the TTTs, the difference is distinct as anticipated.

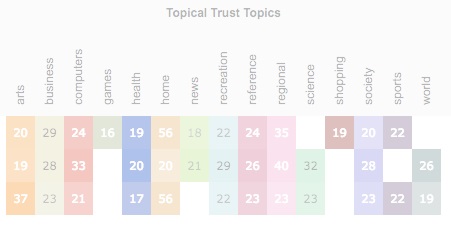

If you now consider the selected domains of the case study, which come from different topical areas, there is a high correspondence, particularly for one topical cluster: Business.

The main category ‘Business’ occurs more or less strongly for all domains, with subdivisions into ‘Accounting’, ‘Employment’ or ‘Construction’. This assignment appears to be understandable overall. What is more interesting are the links from the area “Art/Movies” for Domain 4. As this relates to the site from a firm of architects, these links would also be able to be explained. What could be rather questionable are the links from the area “Computers”, as why does the domain of a tax office have links from this category?

The links from the area “Sports” are also noticeable, as none of the selected domains are in this topic. However, Domain 5 has the highest TTT value, as the domain of an electrical business. The simple explanation for this is sponsoring of a sports club. The link integrations are mostly made by page-wide links to the club’s domain and therefore leave traces in the link profile. Nevertheless, these links are not topically relevant. If you consider the composition of the link profile with respect to the type of link, that again fits the picture that this domain has a very high proportion of image links. However, topically, this integration has clearly “shifted” the link profile of the domain, of which the domain holder is possibly unaware.

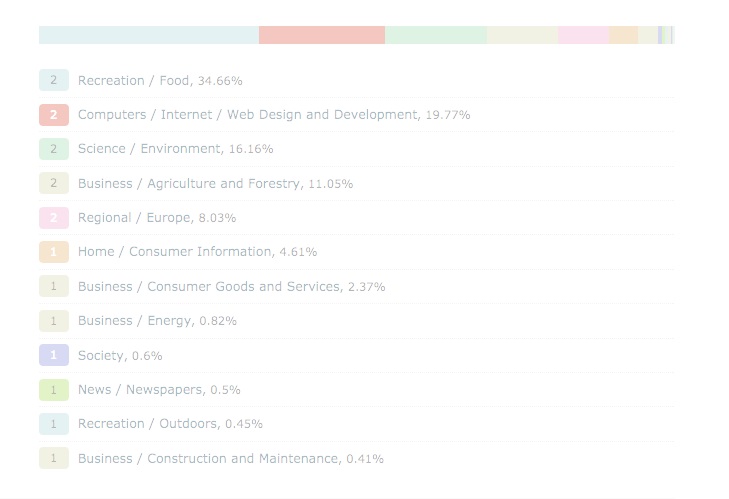

In Domain 7, on the other hand, you can establish a “wide” link profile. Taken more precisely, there is no recognisable focus here. From ‘Food’, ‘Outdoor’ up to ‘Consumer Information’ and ‘Construction’ everything is present, whereby this relates to a website for a building administration company.

It is generally noticeable that, although it relates to companies based locally, only four of seven domains have links from the regional area. Only the firm of architects has a high TTT value in the “regional” area.

On the other hand, if you consider a TTT view of the three domains of the last case study “How Very Different Websites Can Have Similar Flow Metrics” that all come from the same topical area, then the picture looks distinctly different in the overall consideration.

In conclusion, it remains to be established that it is worth examining the very topic of the link profile, to understand what the link profiles comprise. Of course, it is recommended in this case that you look primarily at domains from your own industry. You then obtain better comparison values and this can be combined with several KPIs. As described, parts of the existing profile of competitors may be queried and a different route taken, instead of simply doing “the same”. Primarily the composition of the TTTs of a back link profile should be looked into, if you get the feeling that a domain is ranked in a certain cluster or much better, even if, in the end, other factors that are even more diverse may be decisive for good rankings. It is recognised in Domain 5 that, particularly for smaller domains, it is not the quantity but the quality that can have a considerable effect on link metrics. Attention should always be paid to this.

- Orphan pages: How to recognize them and what is the problem - August 20, 2018

- Domain migrations: watch out for the (internal) links! - May 21, 2018

- Have you considered these 7 factors with your Link Profile Analysis? - March 5, 2018

It would have been useful to include the visibility values for each site. This way we can see if there’s a correlation to TTT and the other Majestic metrics with visibility.

As written, this article only compares Majestic metrics to pages/backlinks/RD/ClassC values.

That doesn’t really answer the question: Does TTT correlate to rankings/visibility?

November 3, 2017 at 4:26 amHi Costa,

thx for your comment.

Especially for SME pages, general visibility is sometimes difficult to use I think. Would more work with a defined keyword set and a project visibility here. The problem with the general visibility (like Searchmetrics) is that it doesn’t work properly for SME pages in some niches and the domains come von different industries.

To answer the question “Does TTT correlate to rankings/visibility?” was actually not the center of that case study but would be of course an idea for another one. In that case I think one should use domains from one niche, but again, in this case the domains are coming from different niches and the aim was to check if differences can be see within the data.

btw. Have you read this case: https://blog.majestic.com/case-studies/how-different-websites-with-similar-flow-metrics-can-be/

Here you can also find information about visibilities and so on.

Happy for further comments.

November 3, 2017 at 7:03 pmI didn’t try it before but when I read this article I got different type of idea. Thank for details about Majestic metrics. Here also have another metrics [EDIT: LINK REMOVED]

November 4, 2017 at 11:47 amthanks with your update.

November 6, 2017 at 8:13 pmI’m not sure of the conclusion here, other than "it varies from case to case". Many SEOs work with SMEs in a market similar to the one described but this study compared visibility/performance of different websites in different sectors.

Surely it would have been much better to choose 5/6 such websites (all ranking on page 1) and compare their ranking for the highest volume search term against the other sites ranking on page 1? This way, you would have (or not!) a correlation as to ‘why’ a site ranks at #6 compared to the sites above.

Clearly, finding such a correlation would pretty much ‘solve’ Google and his is probably the goal of fools and manic SEOs, but I think presenting results as I prescribed would be a more useful study.

What concerns me about Majestic is that the issue of sector specific link profiles seems to be trying to solve a problem that we’re not sure exists, not at the level of the websites in the study, at any rate.

Also of concern with this ‘study’ is the lack of direction (aims/objectives/assumptions) and whilst it is clear there has been distinct analysis, the lack of meaningful conclusion is symptomatic of the ‘less than scientific’ approach at the outset.

This is about as much of an aim as I could gleam from the opening paragraph;

"The purpose of the following brief case study is to make the reader aware that there may be distinct differences, particularly with smaller link profiles"

… which is a) meaningless because b) it’s nothing we don’t know. It is also grammatically poor, as it does not inform the reader of between what items/facts/approaches the differences may appear.

The conclusion leaves far more questions than it answers as the study has been the equivalent of comparing 5 different fruit for taste, when selecting 5 apples or 5 oranges would have been better.

Insomuch as I can offer any worthwhile conclusion, you appear to have discovered that in low volume competition SERPs, the strength of the backlink has more influence than 1. the number of links and 2. the sector ‘relevance’. I think we all knew that at least those working in SEO in a post-penguin world.

November 7, 2017 at 9:35 amHello David,

First of all: thanks for your extended feedback and sorry that it took me some time to response, but I had the feedback on my agenda! I will work with an inline approach.

"Many SEOs work with SMEs in a market similar to the one described but this study compared visibility/performance of different websites in different sectors."

–> Yes, that is true.

"Surely it would have been much better to choose 5/6 such websites (all ranking on page 1) and compare their ranking for the highest volume search term against the other sites ranking on page 1? This way, you would have (or not!) a correlation as to ‘why’ a site ranks at #6 compared to the sites above."

–> I know what you mean, but that was not the intention of this case. I didn’t want to make an analysis within one niche and here, for example, analyse 6 direct competitors. I wanted to show how different SMEs profiles can look like in different niches. All websites mentioned do rank for their main keywords + local combination at least top 5.

"What concerns me about Majestic is that the issue of sector specific link profiles seems to be trying to solve a problem that we’re not sure exists, not at the level of the websites in the study, at any rate."

–> Interesting. So you mean that TTF does not have any value for SMEs? But you would see a problem if an e-commerce website for example would have a high proportion of links from a health, for example? So relevance doesn’t matter for SMEs? Well, I think different here tbh. But I also think that Majestic doesn’t want to solve a problem but more make awareness that these differences do exist and that they can matter.

"This is about as much of an aim as I could gleam from the opening paragraph;

"The purpose of the following brief case study is to make the reader aware that there may be distinct differences, particularly with smaller link profiles"

… which is a) meaningless because b) it’s nothing we don’t know."

–> This may be right for you, who is dealing with that topic daily, but you may forget about a lot of other people out there.

"The conclusion leaves far more questions than it answers as the study has been the equivalent of comparing 5 different fruit for taste when selecting 5 apples or 5 oranges would have been better."

–> As said this was not the intent, but I appreciate your feedback on this in general.

"In so much as I can offer any worthwhile conclusion, you appear to have discovered that in low volume competition SERPs, the strength of the backlink has more influence than 1. the number of links and 2. the sector 'relevance'. I think we all knew that at least those working in SEO in a post-penguin world."

–> Right, but again, so may you know that but there are more people than us "hardcore" SEO’s. But I will take this point with me as an idea of classifying cases. In that way you aren’t being bothered anymore with things you are already aware of. May make sense in general for Majestic.

Finally: Thanks for your feedback. Much appreciate your thoughts!

November 22, 2017 at 3:49 pm